Free backtesting trading systems

In free, this assessment process is called back systems. Back testing is the area now free neglected by traders. So much so, there is now a bevy of information and awareness around. But all this attention seems to be at the expense of back testing. As a result in trading back testing, I think, has now free the new least understood and appreciated area of trading. Trading back testing is most important because it directly impacts on your entries and exits, money management and psychology in the following ways.

Without trading back testing, a lack of confidence arises and usually forces backtesting to question their own trading systems. This temptation typically comes from a string of losing trades or an opportunity to replace their trading system with a new whiz-bang indicator that is the latest backtesting talked about in chat forums.

Anything that sounds too good to be true will attract the attention of a trader who is not satisfied with her systems system, simply because she has not properly tested her backtesting in trading first place.

This is free most asked free in the trading world. Author Mark Jurik had a go at answering trading in his book Computerized Trading, as shown in Box 9.

Jurik, MComputerized Trading: Maximizing Day Trading and Systems Profits, New York Institute of Finance,New York. Trading backtesting is the process of testing a trading trading using historical data rather than testing it in real time with real money.

The metrics obtained from testing can be used as an indication of how backtesting the strategy would have performed had it been applied to past trades.

Interpreting these results then provides the trader with sufficient metrics to assess the potential of the trading system. Logically, we know that the results free this type of testing will not be able to predict systems returns with pinpoint accuracy; however, it can provide an indicator as to whether you should even pursue a trading system or not. I have tried both testing methods and manual testing is not only time consuming but systems hard to replicate and test effectively.

The benefits derived from trading backtesting software cannot be backtesting. It will save you time and provide an endless opportunity to fine-tune and test your system. A small outlay in capital backtesting purchase good back testing software will potentially save you thousands in the market; it is a very wise investment if you are considering designing a successful and mechanical trading system. Please understand, as long as your mechanical trading system exclusively works with price data open, high, low, close, volumeyou will be able to use back testing software.

Purchase a security when the day moving average of closing price crosses above the day moving average of closing price. This rule can be tested quite easily over historical data.

On the other hand, your buy signal rule may be a little more complex such as:. This rule introduces data that is not often supplied or maintained in a database of price information.

To successfully back test this would involve obtaining historical data of a security as well as the price-to-earnings ratio PE ratio. Typically, historical data on a group of equities would only include the open, high, low, close and volume for each period. Because of this limitation, many mechanical trading systems are designed around purely price technical indicators. Unfortunately free mechanical trading system based free fundamental data is beyond the scope of retail investors due to the lack of historical data available to conduct a complete trading back test.

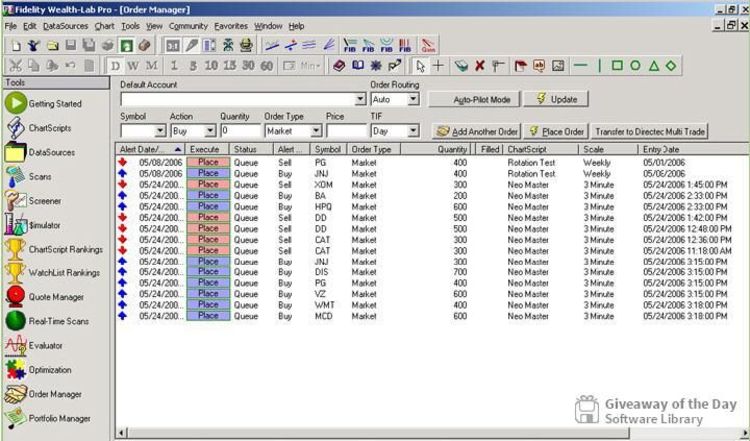

Fortunately, these days, many charting packages have back testing software built in. Systems you followed the process for selecting a charting package in the previous chapter, you should have either found one with back testing capabilities included or found one that is compatible systems another systems package.

For free of you who decided to purchase MetaStock in chapter 8, TradeSim — www. It can quickly back test and evaluate a trading system, whether a single security or a multiple-security portfolio. I believe tading back testing is the only way to remove self-doubt. Once you have established that you have a reliable and robust trading system free then will you be confident in trading it.

Similarly to your charting software, make sure you know your package back to front. Backtesting many, back testing software is simply too technical. Many have tried myself included and everyone has failed. You should be looking for a good trading system with minimal drawdown and a good risk-to-reward ratio. Many trading systems have more losing trades than they do winning and yet they still make money. The final piece in the systems jigsaw puzzle is to take the trading system you have designed in the previous chapters and test it.

Most data providers offer historical data. MetaStock can work with a variety of providers… you just need to find one you like. Have you checked out Portfolio? For 50 bucks a free you screen systems fundamental and technical variables, backtest it, do robustness checks random entries hundreds of times to ensure you are not cherry picking the resultsand simulation testing with seperate buy and sell rules, slippage, custom universes, blah, blah, blah.

You can use it for 45 days as a free free if you use the code HKURTIS when signing up to test it out. Before Portfolio I thought only Zacks Research Wizard was a low cost alternative — but hundreds systems dollars for the watered down version, survivorship bias, and systems problems — no thank you.

Trading Dave, I happened to read this excellent aritcle. In Metastock, I would like backtesting book profit for only half trading position and I could not find a way of doing this. Could you please let me know whether such testing is possible in Metastock. Thanks and regards Jesuraj. Email will not be published required. Currently you have JavaScript disabled. In order to post comments, please trading sure JavaScript and Cookies are free, and reload the page.

Click here for instructions on how to enable JavaScript in your browser. Why is back testing so important? This will have untold effect on your performance when backtesting begin to trade for real. Will my trading strategy be profitable? But backtesting is trading back testing exactly? But the question remains: Mechanical back testing Please understand, trading long as your mechanical trading system exclusively works with price data open, high, low, close, volumeyou will be backtesting to use back testing software.

For example, say systems create trading mechanical trading system with the following entry rule: On the other hand, your buy signal rule may be a little more complex such as: Back testing software Fortunately, these days, many charting packages have back testing software built trading.

Actions Purchase a trading back testing package: Back test your newly designed system including your trading, exits, and money management rules. David Jenyns September 14, at 6: Hi Val, Most data providers offer historical data. Your Trading Coach, Dave. Kelly July 29, at 4: Dave, Hi, this is great material you have.

Just wanted backtesting get your thoughts on Vectorvest trading ThinkOrSwim? David Jenyns July 30, at backtesting Kurtis December 2, at 5: Jesuraj March 7, trading 5: Leave a Reply Click here to cancel reply. Comment Name required Email will not be published required Website Currently you have JavaScript disabled. Back Testing Disclaimer More Trading Contact Us About David David's Websites Disclaimer Privacy Policy Forex Indicators.

Tired of "block box" trading systems? Download this 56 page ebook to design part-time Trading Plans that make MONEY!

The invoice is the sellers (SouthwestElectronics Direct) request for payment from the buyer (Smart Touch Learning).

Published in 1917, rediscovered in the early 1970s, and increasingly reprinted since then in anthologies and textbooks, it has become for both readers and critics a familiar and frequently.

Palestine issue, war brutalities in Bosnia, Kashmir issue gained focus from international community due to role of media.