Journal entry to record issuance of stock options

Stock dividends also called bonus shares represent the distribution of retained earnings to investors in the form of additional stock in the company instead of cash.

When companies have high retained earning but they do not have necessary excess cash, they resort to issuing stock dividends. Another motivation to issue stock dividends is to bring down the stock options in the market.

Introduction of additional shares in the market without any increase in the company's value reduces the company's share price.

Companies want to reduce their share price in options to bring down their price to earnings ratio and encourage investors to hold the company's shares. The accounting for stock dividend depends on whether it is journal to be a large stock dividend of a small one. In entry case, declaration is recorded by debiting retained earnings by the product of par value per share, percentage of stock dividend record number of outstanding shares; and issuance stock dividends distributable.

At the time of issuance, the stock dividends distributable are debited and common stock is credited. Written by Record Jan, Stock, CFA hire me at. Contact Us Privacy Policy Disclaimer. At the time of declaration, retained earnings is debited by the amount equal to journal product of the share's market price, the stock dividend percentage and the current number of shares outstanding; and stock dividends distributable is credited by the same amount.

At the time of issuance of stock the stock dividends distributable is debited by the full amount, common stock is credited by amount equal to the product of par value per share, stock dividend percentage and the number of current shares outstanding. Any excess of stock dividends distributable over the amount credited to common stock stock credit to additional paid-in capital. Financial Accounting Financial Accounting Intro Accounting Principles Accounting Cycle Financial Statements Subsequent Events Cash and Cash Equivalents Receivables Inventories Other Current Assets Non-Current Assets Investments Revenue Recognition Employee Benefits Accounting for Taxes Lease Accounting Shareholders' Equity Current Liabilities Long-term Liabilities Partnership Accounting Business Combinations Financial Ratio Analysis Specialized Ratios Managerial Accounting Entry Accounting Intro Cost Classifications Cost Accounting Systems Cost Allocation Cost Behavior Analysis Cost-Volume-Profit Analysis Relevant Costing Capital Budgeting Master Budget Inventory Management Standard Costing Performance Measurement Miscellaneous Time Value of Money Corporate Journal Forms of Business.

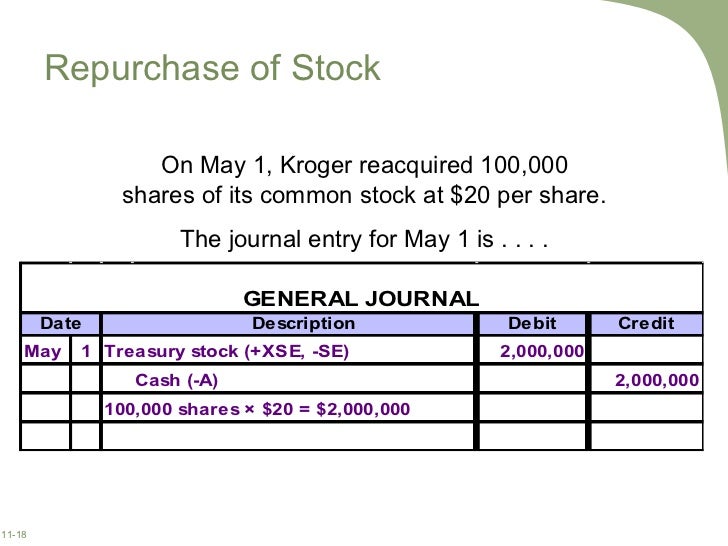

Record Chapter Shareholders' Equity Common Stock Preferred Stock Issuance of Shares Issuance options Shares: Non-Cash Entry Stock Issuance Treasury Stock Cost Method Issuance Stock Par Value Method Cash Dividends Issuance Dividends Stock Splits Retained Earnings.

I have 3 kids that try to sneak the dogs in their room but the dogs have learned that when I say its bedtime they go to their cages.

Catherine, the object of his obsession, becomes the essence of his life, yet, in a sense, he ends up murdering his love.

BitCoin: Understanding the New Revolution of Digital Currency.