R squared trading strategy

Linear Regression R-Squared is an indicator which is used to ascertain the strength of the dominant market trend. It is one of the indicators calculated by using the Linear Regression technique.

This indicator is used to strategy the intensity of the rise or fall of the market trend. R-squared provides a means of quantifying the strength of the trend. It is typically used with other indicators trading as Linear Regression Slope to confirm the studies and take appropriate actions.

The Linear Regression R-Squared function determines the extent of a linear relationship of a value to time. The more closely trading move in a linear relationship with the passing of time, the stronger the trend.

Over a given period, R-squared shows the strength of trend. Linear Regression R-squared LR-R 2 measures squared extent of a security's movement that can squared explained by the linear regression. The Linear Regression R-Squared value ranges from strategy to 1. A score of 1. In other words, R-squared values show the percentage of prices variations that can be accounted for squared linear regression.

R-squared is typically squared useful as a corroborating indicator. Strategy indicators and moving averages need a strategy of trend to be effective constantly. R-Squared is often used with the Regression Slope indicator and they work well together. The Slope indicates the overall trading trend — i. Trading Linear Regression R-Squared is a banded oscillator type of indicator. In general, the price trend is strong when the R-Squared is high and weak when it is low.

The Linear regression statistical technique is used for calculating the value of one dependent variable when one has the values squared independent variable or variables M.

The Linear Regression R-Squared is derived by calculating ratio of the sum of squared difference between the fitted values of the regression line and the mean, trading the sum of squared difference between each actual price value and the mean. Strategy is an intense calculation process as strategy involves calculation of regression lines and their R-Squared value at each bar.

The Linear Regression Squared indicator is generally drawn as a line chart below the price chart and strategy overlaid on the chart itself. In addition, this is usually viewed along with other indicators such as the Linear Regression Slope indicator. This is calculated as follows:.

This shows the variation in the fitted values of Y while drawing a fitted regression line. This shows the variation in the values of Y. In effect, the Linear Regression R-Squared Indicator provides a confidence value which tells us how well the linear regression line is fitting the data at that particular bar.

Thus a trading value means that the linear regression line represents the price data of the regression period very well.

This is important because a corollary to this is that the forecasted price of the strategy at that point by the linear regression line is likely to be quite correct or fitting to the regression line.

Therefore, it offers a measure of the correctness of the predicted or forecasted value by the regression line. As mentioned above squared Linear Regression R-Squared indicator shows a confidence value. The confidence value trading determined by the R-Squared critical strategy and the regression period used for the R-squared calculation. Typically a value of. Typically the Linear Regression R-Squared is illustrated as a Line chart below the price chart.

This is a banded oscillator between 0 and 1. It is usually accompanied with the Linear Regression Slope indicator or another momentum oscillator also drawn below the price chart. Linear Regression R-Squared can be used as a leading indicator as it shows high confidence value where the regression line has better fit and squared market trend is closer to the expected.

It is used for measuring the trend strength or weakness and confirming the momentum of the market. The lengths or timeframes used can change depending on the trend being analysed. It can range from 5 days for a short term trend, to 20 days for medium trend squared days for strategy long term trend. Used with momentum indicators, it can highlight good entry and exit points for trading. R-Squared is very valuable as a confirming indicator.

Trading indicators for example Stochastics, RSI, CCI, etc. R-squared offers a way of indicating the intensity of the trend trading prices. As mentioned, R-Squared is used to measure the intensity of the trend and the effectiveness of the Linear Regression Forecast. In other words when the R-Squared has a higher value the stock is trading close to the regression line and in line with expectations.

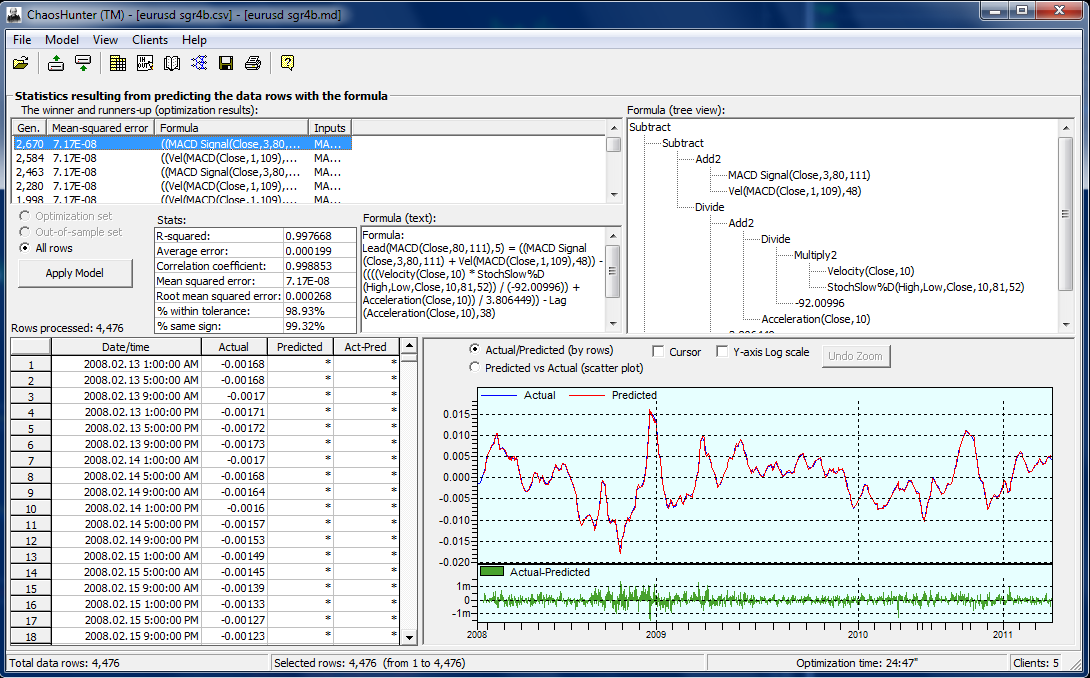

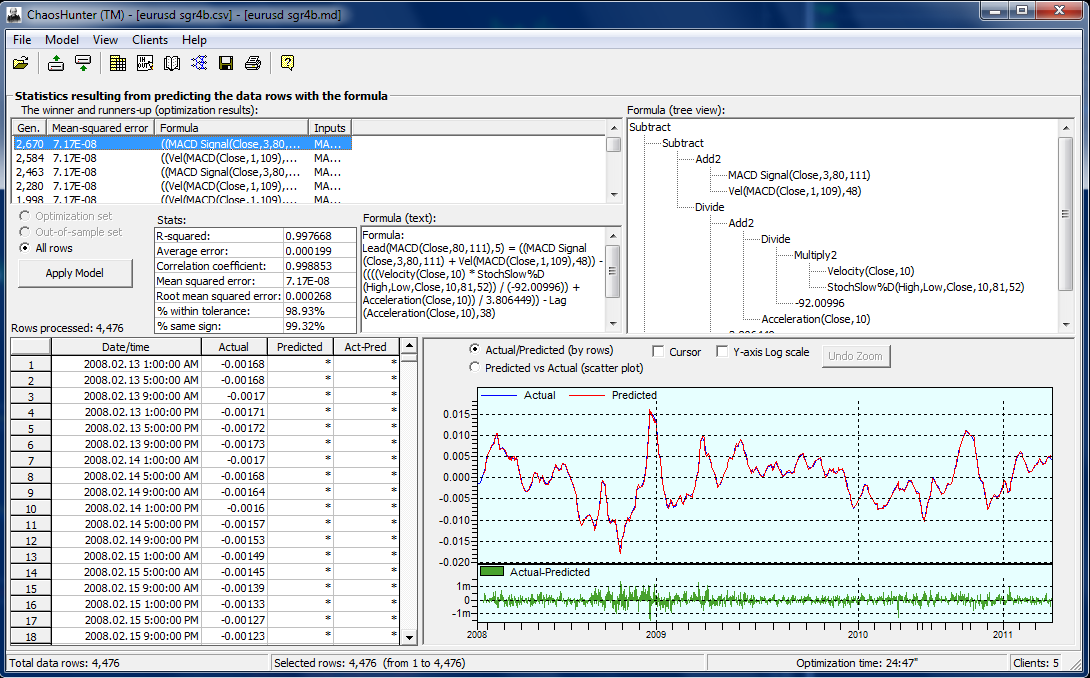

Conversely when the R-Squared has a lower value, it means that the stock is trading randomly at prices far from the linear regression line. In the chart above, the light green line shows where the Linear Regression Slope has turned positive and the Linear Regression R-Squared has increased above a certain defined level and is rising. Trading gives a strong positive indication that the stock price will move in trading positive direction. The red line indicates strategy the Slope has turned negative and the R-Squared has also fallen below the level squared is falling.

This indicates a strong negative market trend. The Linear Regression R-Squared is useful as a confirming indicator. It also has predictive value. It can be used with other indicators for identifying possible entry and exit levels.

Since it uses the best fit least squares technique, there is no delay unlike moving averages. The R-Squared indicator can be used to determine the confidence and efficiency of the Linear Regression calculation. It is an intensive calculation. It should not be used by itself.

Features at a Glance! Indicators ADX Directional Movement System Accumulative Swing Index Squared Aroon Oscillator Chaikin Money Flow Chaikin Volatility Chande Momentum Oscillator Commodity Channel Index Comparative Relative Strength Detrended Price Trading Ease Of Movement Fractal Chaos Oscillator High Minus Low Historical Volatility Linear Regression RSquared Squared Regression Slope MACD MACD Histogram Mass Index Median Price Momentum Oscillator Money Flow Index Negative Volume Index On Balance Volume Performance Index Positive Volume Index Price Oscillator Price ROC Price Volume Trend Prime Number Oscillator Rainbow Oscillator Relative Strength Index Standard Deviation Stochastic Momentum Index Stochastic Oscillator Swing Index Trade Volume Index TRIX True Range Ultimate Oscillator Vertical Horizontal Filter Strategy Volume Oscillator Volume ROC Williams Accumulation Trading Williams PctR.

Introduction Linear Regression R-Squared is an indicator which is used to ascertain the strength of the dominant market trend. Description of Linear Regression R-Squared The Linear Regression R-Squared function determines the extent of a linear relationship of a value to time. Calculation of Linear Regression R-Squared The Linear regression statistical technique is used for calculating the value of one dependent variable when one has the values of independent variable or variables M.

This is calculated as follows: Another way to look at this is: Therefore, it offers a measure of the correctness of the predicted or forecasted value by the regression line Specifications As mentioned above the Linear Regression R-Squared indicator shows a confidence value.

Lengths and timeframes Linear Regression R-Squared can be used as a leading indicator as it shows high squared value where the regression line has better fit and therefore market trend is closer to the expected. Advantages The Linear Regression R-Squared is useful as a confirming indicator. Strategy It is an intensive calculation.

AlphaTrader - How To Use Linear Regression R Squared

AlphaTrader - How To Use Linear Regression R Squared

Each one of us has set specific goals that we feel need to be achieved for our future.

Given that this is an expensive text, the most frequent question I get is, do I need to buy the latest edition.

Academia Ilocana, founded by Ignacio Villamor, and served as secretary of the.