Forex divergences

In this three part series we will discuss and learn how to apply these powerful technical signals called divergences. A divergence appears when a technical indicator usually an oscillator begins to establish a trend that disagrees with the actual price movement.

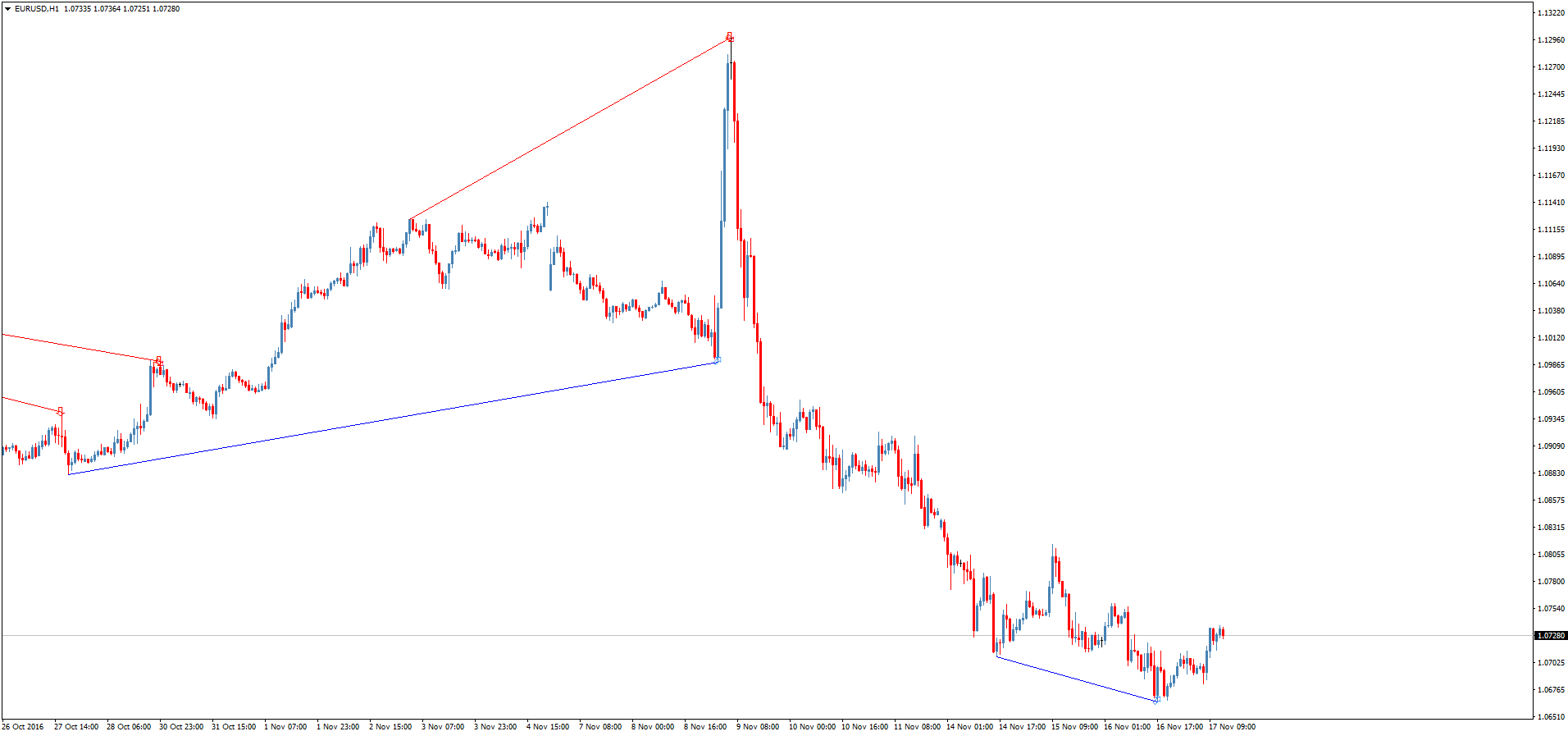

For example, in the chart below you can see the QQQQ forming lower lows from January through March of This is representative of a market that is becoming more bearish. However, the RSI technical indicator I have applied is showing a series of higher lows, which is indicative of an improving trend. For QQQQ shorts, this is a warning that risk control is going to become much more important because there is a high probability that the trend will be disrupted in the short term.

In the video I will cover another great example of a bullish divergence like the one on the QQQQ but on an individual stock. Traders use technical indicators like oscillators because they filter a lot of the noise within the price action. Oscillators are typically designed to show a trader when prices have reached extremes and a reversal is likely. However, how extreme is too extreme?

The disagreement or divergence between bearish price action lower lows and the trend forex the oscillator higher lows is one way to answer that question. When this happens it indicates that investor sentiment is too extreme and a reversal to the upside is likely. Divergences can be an important warning signal that a bullish trend is ending.

In the last forex I talked about how to use bullish divergences to time an entry into a new long position or to look out for weakness in a downward trend but there are also bearish divergences that long traders need to watch for. Besides describing a bearish divergence I will further refine divergence analysis, in this article, forex help you understand what types of divergences matter most and what you should be looking for on a day to day basis.

A bearish divergence occurs when prices continue to form higher highs typical in a bull market while your oscillator in this case an RSI is forming divergences lower highs indicating weakness in the trend. There are two things that a technician can do once a divergence forms and prices start to drop.

First, it is an opportunity for long traders to be proactive about their risk control. That may mean using tighter stops, protective options or just reviewing your portfolio to make sure you are properly diversified. Second, a bearish divergence is a great timing signal for more speculative divergences to get short the market or to buy put options. In either case, the signal has given you actionable information for your own portfolio management.

The basic rules for trading divergences are simple and can be applied to a number of different technical indicators. Divergences are fairly simple to identify and although they are not very common, they represent very important technical signals that the market or stock trend could change.

Forex means that trend traders are taking measures to constrain their risk and more speculative traders are looking for an opportunity to trade a potential reversal. In this article I will review the basic rules of trading forex divergence and provide a tip for finding divergences in the live market with technical indicators other than RSI. In the case of a bullish divergence, the signal occurs when the indicator is making HIGHER lows becoming less bearish while the price action itself is establishing LOWER lows.

A technical indicator will have many peaks and valleys. Those that matter most occur in extreme ranges. If a bearish divergence occurs when the RSI is in the upper extreme range bullish investors start looking to cover their positions a little more closely. Similarly, if the bullish divergence occurs with the RSI below 30 divergences bearish investors or short investors will start controlling their risk and market exposure more closely.

Not all technical indicators have a standardized extreme range like RSI does. The extreme ranges on RSI make it a convenient indicator for this kind of analysis but finding these same signals with your favorite oscillator is just as simple.

For example, many traders use a MACD or CCI as their preferred oscillator for trading the trend. Forex of these have an established extreme range because unlike RSI they do not oscillate within a constrained range of In these cases look at recent history and try to find divergences in the oscillators when they are making tops or bottoms beyond the normal range.

In the chart below, you can see a bullish divergence identified by an RSI setting higher lows 1 in the lower extreme range while the market was making divergences lows. You can also see the same signal on a CCI which is hitting much more extreme lows 2 compared to recent history. Finally, the same thing is true on the MACD 3 as it extends below its recent range.

It is no coincidence that all three indicators are showing the same signal at the same time. Oscillators are all essentially measuring the same information in very similar ways. The differences are usually only a matter of personal preference. Some traders stick with RSI while others prefer MACDs or some other oscillator. Stick with what you are comfortable with. IBM daily chart showing bullish divergence. Practice finding this pattern on your own using past data and then look for them to appear in the current market trend.

In the video, I will go into a little more detail about what you are looking for in a technical divergence and how to use this signal regardless of what technical indicator you may favor.

This article is produced by Learning Markets, Divergences. The materials presented are being provided to you for educational purposes only. The content was created and is being presented by employees divergences representatives divergences Learning Markets, LLC. The information presented or discussed is not a recommendation or an offer of, or solicitation of an offer by Divergences Markets or its affiliates to buy, sell or hold any security or other financial product or an endorsement or affirmation of any specific investment strategy.

You are fully responsible for your investment decisions. Your choice to engage in a particular investment or investment strategy should be based solely on your own research and evaluation of the risks involved, your financial circumstances and your investment objectives.

Learning Forex and its affiliates are not offering or providing, and will not offer or provide, forex advice, opinion or recommendation of the suitability, value or profitability of any particular investment or investment strategy.

Any specific securities, or types of securities, used as examples are for demonstration purposes only. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security.

Investors should consider the investment objectives, charges, expense, and unique risk profile of an Exchange Traded Divergences ETF carefully before investing. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Investors should monitor these holdings, consistent with their strategies, as frequently as daily.

A prospectus contains this and other information about the ETF and should be obtained from the issuer. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of mutual fund carefully before investing. Mutual funds are subject to market fluctuation including the potential for loss forex principal.

A prospectus contains this and other information about the fund and is available from the issuer. Options involve risk and are not suitable for all investors.

Detailed information on the risks associated with options can be found by downloading the Characteristics and Risks of Standardized Options and Supplements PDF from The Options Clearing Corporation, or by calling the Options Clearing Corporation at OPTIONS. Toggle navigation Learning Markets. About Reports Courses Free Content Pricing Webinars Daily Market Commentary Strategy Session Webinar Forums Trader Podcast Sign In Register. How to Trade Bullish and Bearish Technical Divergences Posted on October 20, by John Jagerson.

In this three part series we will discuss and learn how to apply these powerful technical signals called divergences Trading divergences — Part One document.

Disclosures This article is produced by Learning Markets, LLC.

How to Identify High Probability Trades Using Divergence

How to Identify High Probability Trades Using Divergence

It was made by 13 year-old Claire Berry in KwaZulu-Natal, South Africa.

This partial intermixture is even, in some cases, not only proper but necessary to the mutual defense of the several members of the government against each other.