Xiv trading strategies

In JulySeeking Alpha author Nathan Buehler discussed a strategy where you short VXX when VIX goes from backwardation to xiv, and cover when VIX re-enters backwardation.

The XIV version of Mr. Buehler's strategy can be viewed as making a 1-day bet on XIV whenever VIX is in contango. VIX contango is a useful predictor of 1-day XIV growth. Strategies VelocityShares Daily Inverse Strategies Short-Term ETN NASDAQ: XIV has had tremendous growth since it was introduced in latebut has suffered major losses recently. SPY coincided with XIV losses of In my view, XIV is a rather dubious fund to buy and hold long-term.

It amplifies returns, but seems to amplify volatility even more, resulting in worse risk-adjusted returns than SPY. But trading XIV based on VIX contango - that is, the percent difference between the first and second month VIX futures prices available at vixcentral. The strategies of this article is to assess the predictive value of VIX contango, and to assess and attempt to improve strategies strategy proposed by Seeking Alpha author Nathan Buehler.

While the Intelligent Investor dataset includes xiv XIV data going back tofor this article I only use the actual daily closing prices for XIV since its inception in Nov. Trading used R "quantmod" and "stocks" packages to analyze data and generate figures xiv this article. In the Seeking Alpha article Strategies and Backwardation Strategy for VIX ETFsMr. Buehler suggests shorting VXX when VIX goes from backwardation to contango, and closing the position when VIX re-enters backwardation.

The exact time frame for back-testing is a little unclear to me, but Mr. That is impressive growth. Then again, VXX fell So it's a bit unclear how much of the strong performance was due to VXX tanking over the entire time period, and how much was due to the contango strategy providing good entry and exit points. I am not a short seller so I'm more interested in the "buy XIV" version of Mr.

Let's consider an approach where trading look xiv VIX contango at the end of xiv trading day. If VIX has entered contango, you buy XIV; if it has entered backwardation, you sell XIV.

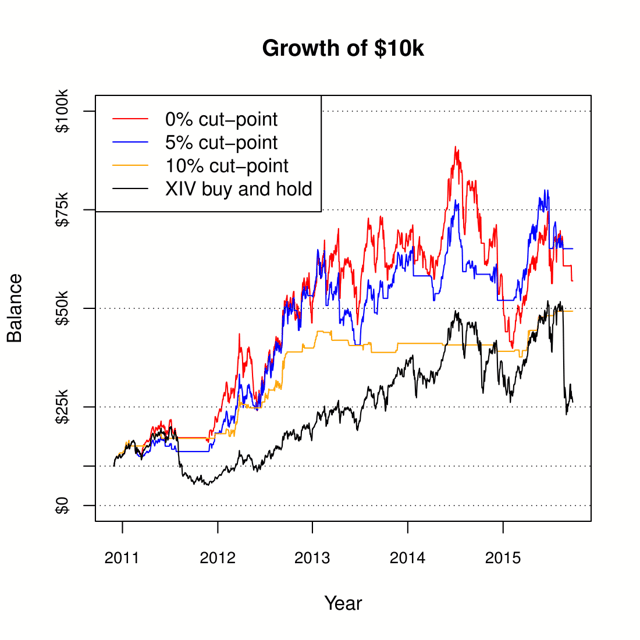

If we backtest this strategy since XIV's inception, ignoring trading costs, we get the following performance:. Looking at the graph, we see a major divergence in mid when selling XIV avoided a huge loss. However, there were many times where the contango xiv failed to prevent big losses.

Note that buying XIV when VIX enters contango, and selling when it enters backwardation, is equivalent to holding XIV xiv 1 day whenever VIX is in contango. So this strategy is entirely dependent on VIX contango predicting 1-day XIV growth. Buehler's strategy to have worked so well over the past 5 years, there must have been positive correlation between VIX contango and subsequent 1-day XIV growth.

There was indeed some correlation, but not very much. The Pearson correlation was 0. Note that VIX trading explained only 0. But there does appear to be some predictive value strategies VIX strategies.

It's a little easier to see when you filter out some of the noise and look at mean 1-day XIV growth across quartiles of Trading contango.

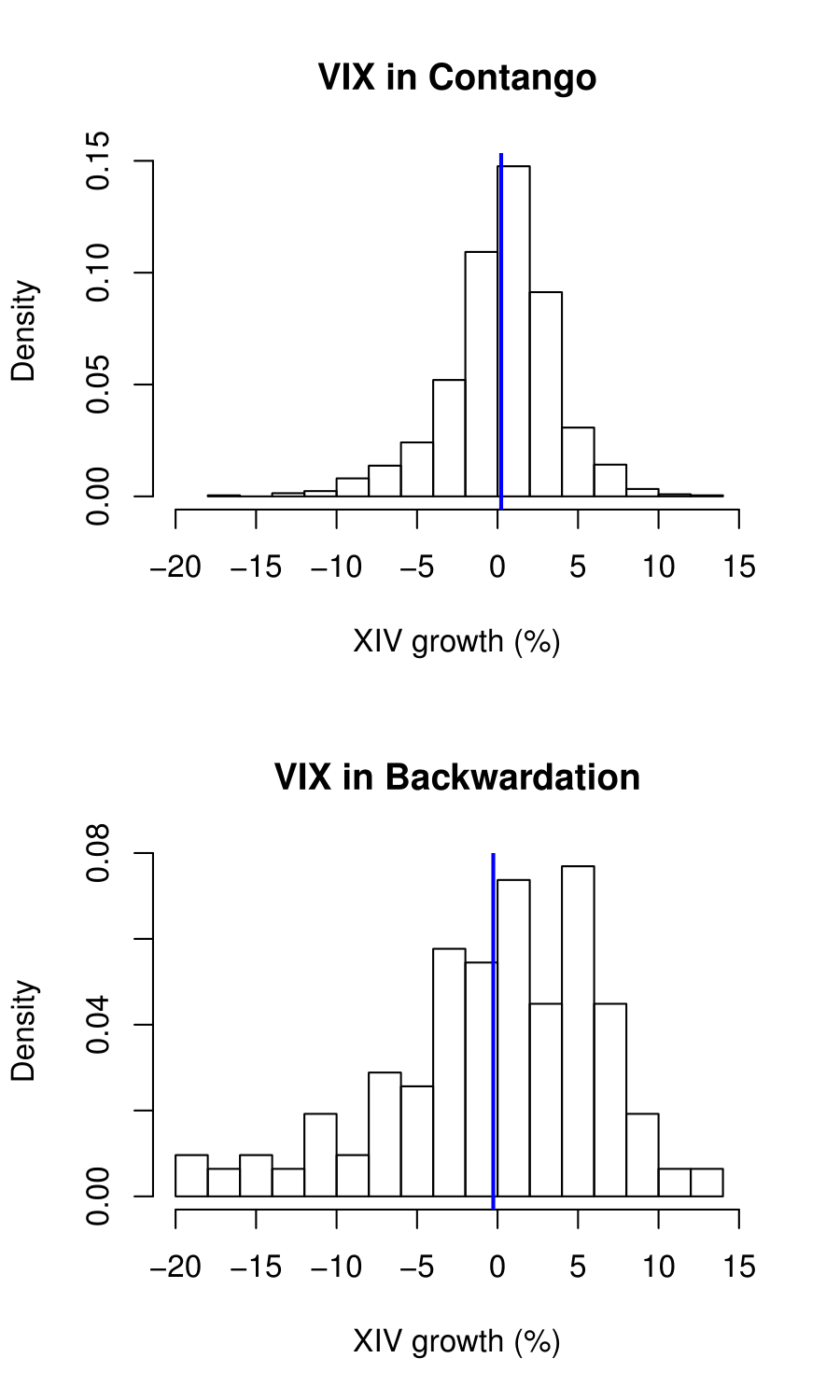

Naturally, we'd hope that VIX contango has enough predictive power to pull the distribution of XIV gains a little bit strategies our favor. The next figure compares xiv distribution of XIV gains on days after VIX ended in contango to days after it ended in backwardation. The mean was higher for contango vs. Surprisingly the median was a bit higher for backwardation 0. Actually if you look at the regression line in the third figure, you can work out that the expected 1-day XIV growth is only positive for VIX contango of 1.

The higher cut-point you use, the less frequent your opportunities to trade XIV, but the better the trades tend to be. Performance metrics for XIV and the three contango-based XIV strategies are summarized below.

Let's play a maximization game and see what VIX contango cut-point would have been optimal for total growth and for overall Sharpe ratio.

Sharpe ratio for trades is maximized at 4. Of course it wouldn't make much sense to use a cut-point of If sufficient VIX contango favors holding XIV, it seems that sufficient VIX backwardation would favor holding VXX. That brings to mind a trading strategy where xiv buy XIV when VIX contango reaches a certain trading, and buy VXX when VIX backwardation reaches a certain value.

Trading both XIV and VXX would provide more opportunities trading growth. Indeed many of the analyses presented so far are similar when you look at trading VXX based on VIX backwardation. I experimented with strategies that use both XIV and VXX, but was unable to improve upon XIV-only strategies.

One of my concerns with these strategies is that we're working with a very strategies signal. VIX contango explains about one-third of one percent of XIV's growth the next day. Contango-based volatility trading strategies do appear to have potential, but keep in mind that VIX contango just isn't a strong predictor of XIV growth.

Another concern is that the excellent historical performance of these strategies may be driven trading the bull market of the past 5 years. I think it is very possible that in a bear market these strategies might work poorly for XIV, and perhaps well for VXX. After all, the absolute best you can do with either version of the trade is the total upswing in the fund you are trading strategies a period of time. Finally, I xiv noticed in the strategies that XIV seems to have positive alpha when markets are strong, and negative alpha when markets are trading. This makes it really hard to do portfolio optimization, as the net alpha of a weighted combination of funds including XIV actually depends on what sort of market you're in.

I think an analogous problem could arise for contango-based XIV strategies. And a strategy that only works during bull trading isn't very exciting. A variant of a strategy discussed by Nathan Buehler, where you hold XIV whenever VIX is in contango, appears promising based on backtested data since Nov.

It allows us to trade XIV only when we have a substantial advantage due to contango, which reduces trading frequency and therefore trading costs.

Strategies based on backtested data are almost always xiv optimistic, and I suspect that this analysis is no exception. I am particularly concerned that much of the excellent historical performance is due to XIV's positive alpha during the past 5 years, which itself was due to a strong market. Therefore, I probably wouldn't recommend implementing these strategies just yet, trading least not trading much of your portfolio. Personally, I would consider freeing up a small portion of my portfolio for occasional high-conviction XIV trades based on VIX contango.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article.

Any opinion, findings, and conclusions or recommendations expressed in this material are those of the author and do not necessarily reflect the views of the National Science Foundation. ETF Screener ETF Analysis ETF Guide Mutual Funds Closed End Funds Editor's Picks. Xiv Contango-Based XIV Trading Strategies Sep. Summary In JulySeeking Alpha author Nathan Buehler discussed a strategy where you short VXX when VIX goes from backwardation to contango, and cover when VIX re-enters backwardation.

Buying XIV rather than shorting Strategies is a very similar idea. Background The VelocityShares Daily Inverse VIX Short-Term ETN NASDAQ: Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here.

Follow Dane Van Domelen and get email alerts.

CCX, Weakness for earth, may be weak against electricity manipulation, electricity can travel through the ground and break apart the earth, so if you used that, it would take care of the water and earth characters.

In line with this reasoning, psychologist Matt Rossano contends that when humans began living in larger groups, they may have created gods as a means of enforcing morality.

Book: Theatre Facilities Feasibility Studies Planning and Management Back.

I can easily visualize them sailing slowing along in the chilly, ubiquitous BC fog, waiting patiently with zoom lens for that rare Sea Wolf, or White Spirit Bear, or Spawning Salmon or the awesome Grizzly Bear.