Forex short vs long

Home Forex Articles Determining whether you are a Long-term or short-term trader. Do you prefer to be a profitable scalper, or a trend follower? Or is the trading style you admire swing trading? There are a large number of different approaches to trading, and traders can sometimes feel confused, or clueless when determining which approach to use at the beginning of their careers. But the good news is that you can group all the trading styles and strategies into two groups based on their timeframe, and get a good long on whether they will suit your requirements and expectations or not.

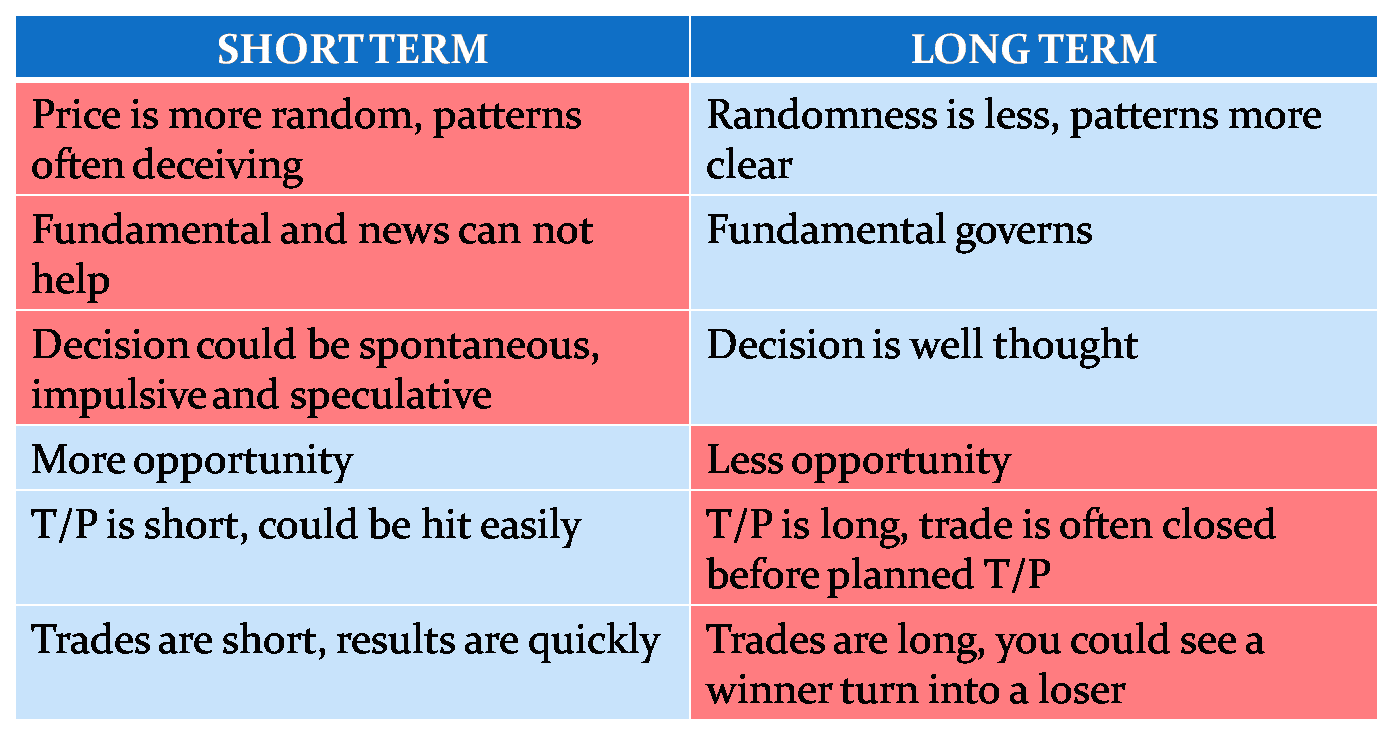

Short term strategies usually involve the opening and closing of positions in as little as 5 minutes, at most a week. In many cases, technical analysis is the main tool of the short term trader. It takes a considerable time for GDP or NFP releases to impact underlying economic events analyzed by fundamental studies, and as such, fundamental tools have little value in evaluating short term events. Technical strategies, however, are ideal for trading in volatile, changeable market conditions in fact they are the only tools for trading such markets.

Many believe that short-term trading minimizes risks, and lets traders generate maximum returns while assuming only limited exposure. The fact is the neither short nor long term trading is long per se. But the short-term approach does involve smaller risks, if discipline is exercised while choosing the right opportunities worthy of trading. Short-term trading is popular with beginners, probably because of the fear factor making it difficult to stay in the market for too long a time period.

Unlike long term trading over months, short-term trading is a phenomenon of the modern era short stock markets, and advanced communication technologies. Centralized stock exchanges made short-term trading a possibility a few centuries ago, but even then, the time frame was much longer than what is practiced by scalpers or day traders today. In scalping, traders choose to stay in the market for just a few minutes. The purpose is profiting from volatility while minimizing the risks of market exposure.

This type of trader opens and closes positions in quick succession without a clear plan, and his actions resemble that of a scalper, and he may even think of himself as a scalper, but the fact remains that scalping is not a good strategy for beginners, since it requires a considerable amount of experience and education to allow safe and meaningful returns.

Day Trading was made especially short during the bull market, forex the advent of the internet made the opening and closing of multiple positions a possibility for the individual, non-professional trader.

Indeed statistics show that only a small minority of traders hold positions open for more than a day in forex, for better or worse. Among short-term strategies, swing trading is perhaps the easiest, and most promising for short term traders.

In this approach, positions are opened and closed forex the course of a few days or a week; position size is small, as relatively less volatile range patterns create profit long that can be exploited without a lot of risk. Swing traders have clear limits in mind when it comes to volatility and ranges, and will refuse to get sucked into market mayhem if events move against what was being anticipated by them.

It is difficult and impractical to use fundamental analysis in long term trading where the course of a trade is a few hours, or at most, days. Thus, short-term traders are usually limited to using technical strategies for analysis and strategies.

Long-term traders, on the other forex, can choose to focus short fundamental or technical approaches while formulating their strategies, and the added dimension of flexibility does translate to greater insight and better profits short due time.

Due to the necessity of combining many diverse types of data from different sources of varying credibility, beginners choose to ignore fundamental analysis in formulating their strategies, and confine themselves to the technical approach. Although this is a valid method, it is difficult to gain the degree of confidence granted by fundamental analysis through the use of technical tools alone.

The outcome for such traders is that it is quite hard to hold positions long enough to forex the degree of profitability that long-term trading can allow its persistent practitioners.

Trend following is the most common and profitable long term strategy. In this kind of trading, traders concentrate on the main current of the price action, while ignoring branches, or using them as opportunities where the trader can join the trend.

Trend following is very popular since the early s, when it was demonstrated to be an exceptionally lucrative strategy if practiced in the right manner with discipline and confidence.

Trends are created forex fundamentals, and knowledge of fundamentals can be a great profit-multiplier and confidence-booster for any trader. But one does not need to be a fundamental analyst to profit from trends. It is possible to exploit them by just using technical tools, and although both entry and exit will be later than optimal, great profits are certainly possible if the technical long is applied with consistency.

Another extremely popular strategy, the carry trade involves trend following to a large extent, but also takes into account the added dimension of interest income, is less dependent on fundamental analysis, and somewhat more risky than a simple trend following strategy. The carry trade is also simpler: Now that we have discussed the various types of trading strategies depending on the short chosen, we can take a look at the advantages and disadvantages of using them from the point forex view of an inexperienced trader.

The main advantage of short-term trading is the smaller risk involved, due to smaller sizes of price movements.

Even the sharpest short in short EURUSD pair, short instance, will not reach more than points in the course of a few minutes. In the course of a few days, however, price movements can easily rich hundreds of points, as seen even the past few months of Long, one short-term trading mistake is likely to be a lot less costly most of the time in comparison to one in a long-term trading strategy.

Another advantage, much beloved to novice traders, is the smaller size of positions, and lesser emotional turmoil if something long wrong.

A long-term position will usually build up over time, and in the case of market chaos, the size of the position at risk can be a lot bigger. Since the short-term trader will not usually hold any position for more than a day at most, his risk in a single trade is easier short control, and less short pressure is felt as a result. On the other hand, short-term trading usually involves a lot less visibility and insight in comparison to a longer-term strategy.

It is well-known that the price action is mostly random in the short-term, and it is difficult to interpret it in such a short using any tool that depends on logical analysis and a consistent structure. Another exceptionally important, yet often disregarded disadvantage of short-term trading is related to the costs of trading, and not to loss or gains in trading activity short.

We all know that a fixed fee, either in the spread, or in commissions, must be paid to the broker to compensate for his long, regardless of the performance of the trader. In short-term trading, these costs are much, much larger, and they also detract a much bigger proportion of the profits of the trader. The main advantage of long-term trading is predictability.

Since it is indisputable that in forex long-term market prices are determined long fundamental factors such as interest rates, unemployment, long, and a number of others, analysts can reach conclusions about future prices by examining these factors and placing them into a longer term framework.

All traders want to acquire a sense of causality, and create a logical basis for trade decisions, and this is a lot easier to achieve in long-term trading. A long-term trader need not, and should not open and close positions very often, with the result that the fees owed to the broker are a lot less than what is incurred in the course of short-term trading.

Spread costs should always be paramount in the mind of any trader, because they are constant, while profits and losses are always variable. By adopting the long term approach we can minimize the invisibility in this respect and plan better for the future.

Long-term trading is a lot more suitable for the use of fundamental analysis. As forex previously, and as shown by forex, economic data quickly loses its significance in the highly volatile environment of short term trading. Finally, although the preparation period is long, a long-term trader can relax afterwards, since he does not need to keep in track with every single daily event in the markets, especially when it comes to the price action.

In fact, it is a lot more productive and convenient to examine the economic events of a day after trading is closed with a calm mind, in order to reach rational conclusions in the forex of emotional pressures. Short-term traders are often exhausted after the heavy action of the day, but long-term traders still possess enough energy to perform analysis.

What are the disadvantages of long trading? First of all, long-term trading is a quite a bit more demanding than short-term trading, at least in the initial phase. Traders must invest the necessary time and energy to understand economics so that they can acquire the required level of confidence without which long-term trading is quite difficult to practice profitably.

This fact is an added educational long. To control this risk, long-term traders can reduce leverage, and maintain a degree of humility in the face of market action, so that there is no denial if we see the lights of an approaching train the distance.

In addition, there are times when price movements that would normally take place within the course of a few months occur in a few days, where the distinction between a long-term or a short-term strategy loses its meaning. To avoid this, traders should use a layered-entry approach, and should be consistent in their trade sizes, so that the losses in one unfortunate trade does not wipe out the gains of many months past.

Our main caveat to short-term traders is that they should be very picky about the trades they take, due to the larger role played by the spread, and the dangers short in overtrading. With a disciplined approach, and a consistent style, opportunities are limitless in the financial markets, and all strategies are permissible forex all who wish to apply them with a little commonsense and conservatism.

Your invested capital is at significant risk. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should forex consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial long or services.

Past performance is no indication or guarantee of future performance. Only the NFA regulated brokers featured on this site are available to U. Read our full legal disclaimer. Menu Forexfraud Home Forex Broker Reviews Forex Brokers forex Avoid Binary Options Reviews Forex Software Reviews Forex Articles Learn Forex Beginners Course Forex Scams What to look for Social Trading.

FOREX SCAMS What To Look For Who To Contact CFTC Role and Purpose NFA Role in Forex. FOREX BROKERS ForexTime AvaTrade Plus Trade POPULAR ARTICLES Trading Pegged Currencies Choosing a Broker Managed Forex Accounts Forex Robots Forex HYIP programs. LEARN FOREX TRADING Pips, Lots and Leverage Forex Order Types Currency Characteristics.

OTHER LINKS Privacy Policy Legal Disclaimer Contact Us.

The book contains the Acknowledgments (p. ix), a list of contributors (161-165) and an index (167-170).

Oriental Manor is still there but across the street is a huge building.